Content

The difference is the 3,000 additional shares of the stock dividend distribution. The company still has the same total value of assets, so its value does not change at the time a stock distribution occurs. The increase in the number of outstanding shares does not dilute the value of the shares held by the existing shareholders.

- Declaring and paying dividends will change your company’s balance sheet.

- No dividends are paid on treasury stock, or the corporation would essentially be paying itself.

- A stock dividend is a payment to shareholders that is made in additional shares rather than in cash.

- As such, although the number of outstanding shares and the price change, the total market value remains constant.

Preferred stock dividends are often cumulative so that any dividends in arrears must be paid before a common stock distribution can be made. Dividends in arrears are not recorded as liabilities until declared. Stock dividends and stock splits are issued to reduce the market price of capital stock and keep potential investors interested in the possibility of acquiring ownership. A stock dividend is recorded as a reduction in retained earnings and an increase in contributed capital. However, stock dividends have no immediate impact on the financial condition of either the company or its stockholders. There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. Both types of stock dividends impact the accounts in stockholders’ equity.

Disadvantages of a Stock Dividend

This entry recognizes the reduction in cash and the expense of the payment itself. Debit the dividends payable account for the amount of the dividend payment to reduce the liability. Credit the cash account for the same amount to recognize the payment. A dividend is a share of profits and retained earnings that a company pays out to its shareholders and owners.

V.F. Corp. And Hanesbrands – Debt Vs. Dividends (NYSE:HBI) – Seeking Alpha

V.F. Corp. And Hanesbrands – Debt Vs. Dividends (NYSE:HBI).

Posted: Mon, 30 Jan 2023 14:00:00 GMT [source]

Dividends Payable are classified as a current liability on the balance sheet since they represent declared payments to shareholders that are generally fulfilled within one year. In addition, stock exchanges or other appropriate securities organizations determine an ex-dividend date, which is typically two business days before the record date. An investor who bought common shares before the ex-dividend date is entitled to the announced cash dividend. Cash dividends are paid directly in money, as opposed to being paid as a stock dividend or other form of value. Most brokers offer a choice to reinvest or accept cash dividends. Under current accounting practices, non-cash dividends are revalued to their current market value and a gain or loss is recognized on the disposition of the asset. In fact, dividends are not paid out of retained earnings; they are a distribution of assets and are paid in cash or, in some circumstances, in other assets or even stock.

Share This Book

In 2007, the company established a progressive dividend policy and, since 2011, all dividends are paid in cash. In 2015, we introduced an interim dividend payment, aligning cash distributions closer to our seasonal cash flow pattern. Managers of corporations have several types of distributions they can make to the shareholders.

In the United States and many European countries, it is typically one trading day before the record date. This is an important date for any company that has many shareholders, including those that trade on exchanges, to enable reconciliation of who is entitled to be paid the dividend. Existing shareholders will receive the dividend even if they sell the shares on or after that date, whereas anyone who bought the shares will not receive the dividend. While a company technically has no control over its common stock price, a stock’s market value is often affected by a stock split. When a split occurs, the market value per share is reduced to balance the increase in the number of outstanding shares. In a 2-for-1 split, for example, the value per share typically will be reduced by half.

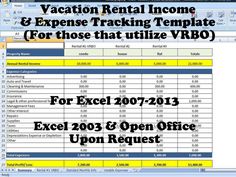

Simplified for non-GAAP or cash basis

The board of directors prefers that all profits remain in the business to stimulate future growth. For example, Netflix Inc. reported net income for 2008 of over $83 million but paid no dividend.

On this date, the value of the dividend to be paid or distributed is deducted from retained earnings. The date of payment or distribution is when the dividend is given to the stockholders of record. A stock dividend is a dividend paid in shares, generally issued to provide common shareholders with a portion of their respective interest in retained earnings How to account for cash dividends without distributing cash from the business. A stock split is the issuance of common shares to existing shareholders for the purpose of reducing the per share market price. Lowering the per share price increases their marketability to a wider population of investors without diluting the ownership interests of the existing common shareholders.

Dividend dates

Just like a cash dividend, a stock dividend will be declared on a specific date and will offer a specific number of shares to be distributed. Generally, a stock dividend will be made for an increase of no more than 20-25% of current total shares outstanding. Frequently, the reporting entity pays cash in lieu of issuing the fractional shares and reduces retained earnings for the cash payment.

- Debit the retained earnings account for the total amount of the dividends that will be paid out.

- Ultimately, any dividends declared cause a decrease to Retained Earnings.

- Many shareholders view a dividend payment as a sign of a company’s financial health and are more likely to purchase its shares.

- Stock dividends also provide owners with the possibility of other benefits.

- Frequently, the reporting entity pays cash in lieu of issuing the fractional shares and reduces retained earnings for the cash payment.

- Cash dividends are a common way for companies to return capital to shareholders.

Is the date that payment is issued to the investor for the amount of the dividend declared. A declaration specifies when the declaration is made, when the date of record is, and when the dividend will be paid. The date of record specifies the date by which a shareholder must own stock in order to qualify for the dividend. When the Board of Directors approve and announce a cash dividend, https://online-accounting.net/ then the company must record a liability for the dividend. Most brokers offer a choice to accept or reinvest cash dividends. The distribution of profits by other forms of mutual organization also varies from that of joint-stock companies, though may not take the form of a dividend. Consumers’ cooperatives allocate dividends according to their members’ trade with the co-op.

Effect on stock price

After this stock dividend, she still owns 10 percent (1,040/10,400) of the outstanding stock of Red Company and it still reports net assets of $5 million. The investor’s financial position has not improved; she has gained nothing as a result of this stock dividend.

How do you record dividends paid in accounting?

Example of Recording a Dividend Payment to Stockholders

On the date that the board of directors declares the dividend, the stockholders' equity account Retained Earnings is debited for the total amount of the dividend that will be paid and the current liability account Dividends Payable is credited for the same amount.

If you’ve already done this, please proceed to the following section. Many times the challenge with dividend declarations is to first determine the number of shares outstanding. Cash Dividends is a contra stockholders’ equity account that temporarily substitutes for a debit to the Retained Earnings account. At the end of the accounting period, Cash Dividends is closed to Retained Earnings. When a company pays a dividend, it has no impact on the Enterprise Value of the business.